Auto Owners Insurance Login – Secure Account Access in 2025

Accessing your Auto Owners Insurance account online ensures you can manage every aspect of your policy without waiting on hold or visiting an office. Through the secure login portal, you can pay premiums, download ID cards, review coverage details, and track claims in real time. This system is optimized for desktop and mobile use, giving policyholders full control from anywhere, 24/7. Built with top-tier encryption and user-friendly navigation, the Auto Owners Insurance login is designed to simplify insurance management for modern drivers.

Compare quotes from top providers

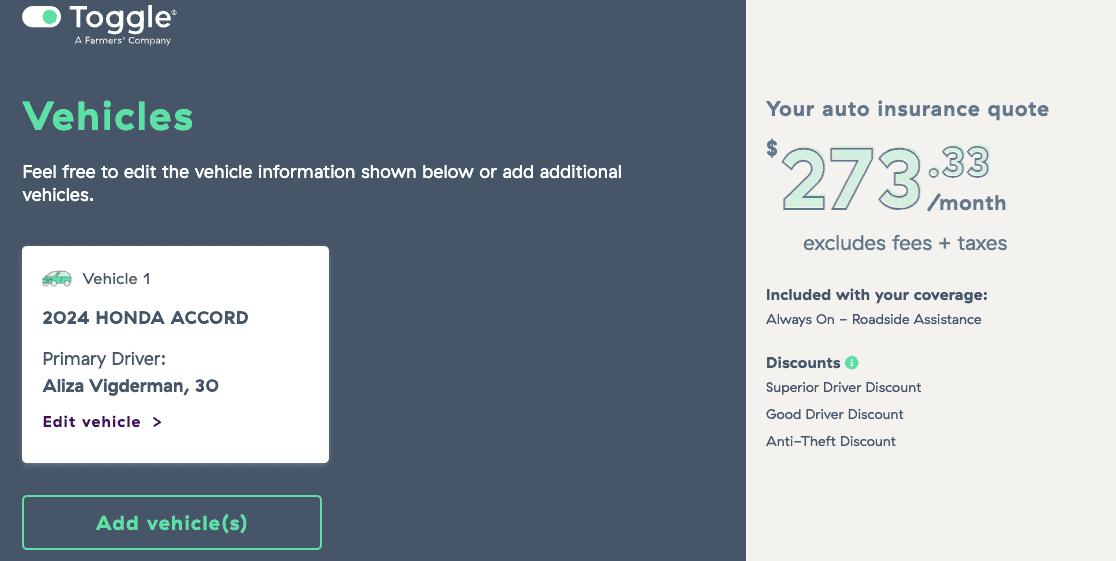

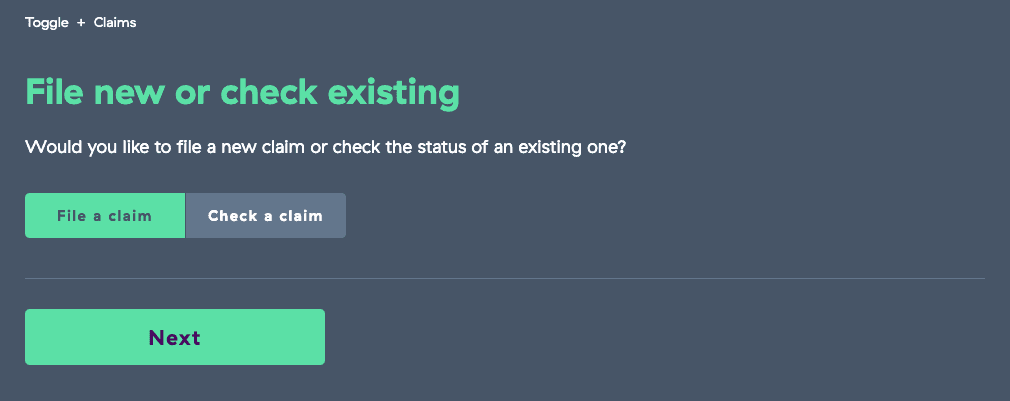

I’ve been reviewing auto insurance companies for a long time, so when I came across a company I hadn’t heard of before called Toggle, I was intrigued. It turns out Toggle is Farmer’s latest brand, and many 21st Century customers are being migrated to it. For everyone else, Toggle is available in just 14 states: Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, Ohio, Oregon, South Carolina, Tennessee, Texas, Virginia, and Wisconsin. The company has no local agents. Rather, the entire process, from buying to managing your policy, takes place on its website or via its call center. Is it the right insurance company for you? Let’s decide together.

When it comes to insurance, there’s no one-size-fits-all. If you’re not sure where to start, check out our top picks for the best auto insurance companies.

Auto Owners Car Insurance – Reliable Coverage for All Drivers

Auto Owners car insurance delivers a comprehensive range of options to protect you in nearly any driving situation. Whether you need basic liability to meet state requirements or full coverage for maximum security, policies can be tailored to your lifestyle, vehicle type, and budget. Coverage extends to bodily injury, property damage, medical expenses, and more. Drivers also have access to optional add-ons like rental car reimbursement, accident forgiveness, and roadside assistance. This flexibility allows customers to create a plan that offers both peace of mind and financial protection.

Auto Owners Auto Insurance – Customized Plans for Your Needs

Auto Owners Insurance Near Me – Local Expertise You Can Trust

Auto Owners Insurance Agent Login – Professional Tools for Agents

The Auto Owners insurance agent login is an advanced platform that allows licensed professionals to manage client accounts seamlessly. From processing new applications and generating quotes to submitting claims and tracking settlements, the system streamlines operations and enhances client service. Agents can also use it to access educational resources, track renewals, and apply discounts. This technology-driven approach helps agents deliver faster, more accurate assistance to every customer.

Auto Owners Car Insurance Quote – Quick and Personalized Pricing

Getting an Auto Owners car insurance quote is straightforward and fast. Customers can request a quote online by providing driver history, vehicle details, and preferred coverage limits. The system uses this information to generate accurate, customized rates, ensuring you’re not overpaying for unnecessary coverage. Quotes can also be obtained directly from local agents, who may offer insights into available discounts, seasonal promotions, and coverage combinations that further reduce costs without sacrificing protection.

Auto-Owners Car Insurance – Nationwide Reputation for Excellence

Car Insurance Auto Owners – Affordable Options with Strong Benefits

Auto Owners Insurance Car Insurance – Full Protection Plans

DID YOU KNOW?

Auto-Owners Insurance Car Insurance – What Sets It Apart

Auto Owners Car Insurance Customer Service – Support Around the Clock

Reviews of Auto Owners Car Insurance – What Customers Say

Auto Owners Classic Car Insurance – Specialized Protection for Collectibles

Auto Owners classic car insurance offers tailored coverage for antique, vintage, and specialty vehicles. These policies typically feature agreed value protection, ensuring that in the event of a total loss, you receive the car’s insured value without depreciation deductions. Coverage can also extend to restoration projects, rare parts, and limited-use driving conditions.

Auto Owners Car Insurance Login – Manage Your Policy Anywhere

With Auto Owners car insurance login, customers can access their accounts at any time to make payments, download proof of insurance, update coverage, and track claims. This convenience eliminates the need for in-person visits and ensures policyholders can take care of important tasks instantly.

Auto Owners Car Insurance Policy – Understanding Your Coverage

An Auto Owners car insurance policy contains all the essential details about your protection, including coverage types, limits, deductibles, and endorsements. Reviewing your policy regularly can help you identify opportunities to adjust coverage for better protection or cost savings.

Auto-Owners Car Insurance Quote – Get a Rate That Fits Your Budget

An Auto-Owners car insurance quote provides a clear breakdown of costs, coverage limits, and optional features. The quoting process is designed to be transparent, allowing customers to see exactly what they’re paying for and make informed choices about coverage.

Auto-Owners Insurance for Car – Flexible Coverage Nationwide

Auto-Owners insurance for car drivers is available across many states, offering adaptable policies to suit a variety of needs. From commuter vehicles to weekend sports cars, coverage can be tailored to ensure protection in any driving scenario.

Best Car Insurance Companies – Auto-Owners FAQ

How much is Auto Owners car insurance on average?

Most policyholders pay between $1,200 and $1,700 annually, depending on their location, driving history, and chosen coverage options. Rates may be lower for safe drivers with clean records.

What is the minimum coverage offered by Auto Owners auto insurance?

The company meets or exceeds state-required liability limits for bodily injury and property damage, ensuring compliance with local insurance laws.

Do I need to log in to manage my Auto Owners car insurance policy?

Yes, the Auto Owners Insurance login portal allows you to securely manage payments, view documents, and file claims without visiting an office.

How do I get an Auto Owners car insurance quote?

You can obtain a quote online, through a mobile app, or via a licensed agent. Providing accurate vehicle and driver details helps ensure the most precise pricing.

Does Auto Owners offer classic car insurance?

Yes, Auto Owners provides specialized coverage for classic, antique, and collectible cars, including agreed value and restoration coverage.

How can I contact Auto Owners car insurance customer service?

Customer service is available 24/7 by phone, email, or live chat, ensuring you can get assistance whenever you need it.